The No Surprises Act is a double-edged sword: it’s a blessing to patients and a potential nightmare for providers. If you’ve struggled with underpayments since the No Surprises Act (NSA) went into effect, you’re not alone.

You’ve taken an oath to treat patients and do no harm, expecting to be paid your worth. But then you receive insurer payments that don’t come close to covering your costs. The NSA was designed to protect patients from balance-billing, but it also gives you a legal pathway through Independent Dispute Resolution (IDR) to fight for the reimbursement you deserve.

The challenge? Navigating NSA claims is far from simple. Providers often lose revenue not because their cases lack merit, but because they make preventable mistakes during arbitration.

Luckily, you don’t have to make these same mistakes. Recognizing these common pitfalls means you can resolve denied NSA claims and protect your practice’s financial health.

Mistake #1: Missing Strict Filing Deadlines

The NSA comes with unforgiving timelines. From the moment you receive an initial payment or denial, you enter a limited 30-day negotiation period. This is followed by narrow windows to file an arbitration notice and submit offers. Missing even a single step means losing your right to dispute the claim.

Many providers struggle here because administrative teams are already balancing heavy workloads. NSA claims easily get lost among competing priorities. The best way to avoid this mistake is to establish a reliable tracking system, usually with the help of a specialized partner, to monitor every deadline. Keeping each stage on schedule helps protect your eligibility for arbitration. It also increases your chances of securing full reimbursement.

Mistake #2: Underestimating the Complexity of Arbitration

You might assume arbitration is just another form of appeal, but the NSA process is more technical. To prove your case, arbitrators need you to provide detailed evidence and proof that you’ve complied with documentation standards. Without this, your case is weak and may not hold up.

Underestimating the nuances of the arbitration process can leave your case riddled with holes. And insurance won’t pay out unless your case is airtight. To solidify your claim, treat every arbitration case like a formal legal proceeding. Gather strong evidence, prepare compelling arguments, and work with an expert medical claim underpayment recovery team. They can help you navigate the law and ensure a win.

Mistake #3: Accepting Low Initial Payments Without Dispute

Insurance companies count on you accepting their first offer. Most of the time, these payments are only a fraction of your billed charges. Many providers are already overwhelmed by the NSA’s technicalities, so they throw in the towel and accept the insurer’s terms rather than pursuing arbitration.

But giving in means you’ll leave significant money on the table. In many cases, arbitration awards providers five to ten times more than insurers initially offer. To avoid this mistake, stop viewing low payments as the end of the story. Treat them as the starting point for a process that can yield fair reimbursement when challenged correctly.

Mistake #4: Bearing the Financial Risk Alone

One of the biggest deterrents for providers is the upfront cost of arbitration. Filing fees and administrative costs can feel like a gamble, especially if you’re not confident in the process. This leads many practices to skip arbitration entirely, even with a strong case.

You don’t need to shoulder this risk. Instead, partner with arbitration representation for medical groups with no upfront cost. These contingency-based partners can advance these costs on your behalf, and they only collect a fee if the case is successful. This model allows you to pursue arbitration without draining your cash flow.

Mistake #5: Overlooking State-Level Arbitration Options

While the NSA sets a federal framework, many states already had surprise billing laws in place before it was passed. Depending on where you practice, a state-level arbitration process may actually yield better results than the federal system. Providers often make the mistake of defaulting to NSA arbitration without evaluating whether state law offers a stronger route.

For example, states like New Jersey, New York, and Texas have independent dispute resolution mechanisms with different fee structures and provider protections. If you’re practicing in these regions, you might be entitled to higher reimbursements under state law. Always review both federal and state options before filing and choose the path that maximizes your recovery.

How You Can Avoid These Pitfalls

Now that you know the most common mistakes, the solution becomes clear: build a reliable system that prevents them. Whether you do this internally or through a partner, you’ll need to ensure your practice:

- Tracks every deadline with precision to avoid forfeiting claims

- Prepares airtight evidence and coding for each arbitration

- Challenges every underpayment instead of accepting low offers

- Shifts arbitration costs and risks off your balance sheet

- Evaluates both federal and state dispute options to maximize results

Focusing on these areas helps you turn the NSA from a burden into a financial recovery tool that consistently delivers fair reimbursement.

Avoid Mistakes and Bring Home More Revenue

Every mistake avoided is more revenue for yourself and your staff. If you treat NSA claims as an opportunity rather than a burden and partner with expert recovery teams, you can bring home the income that insurers want you to leave behind.

Video

Infographic

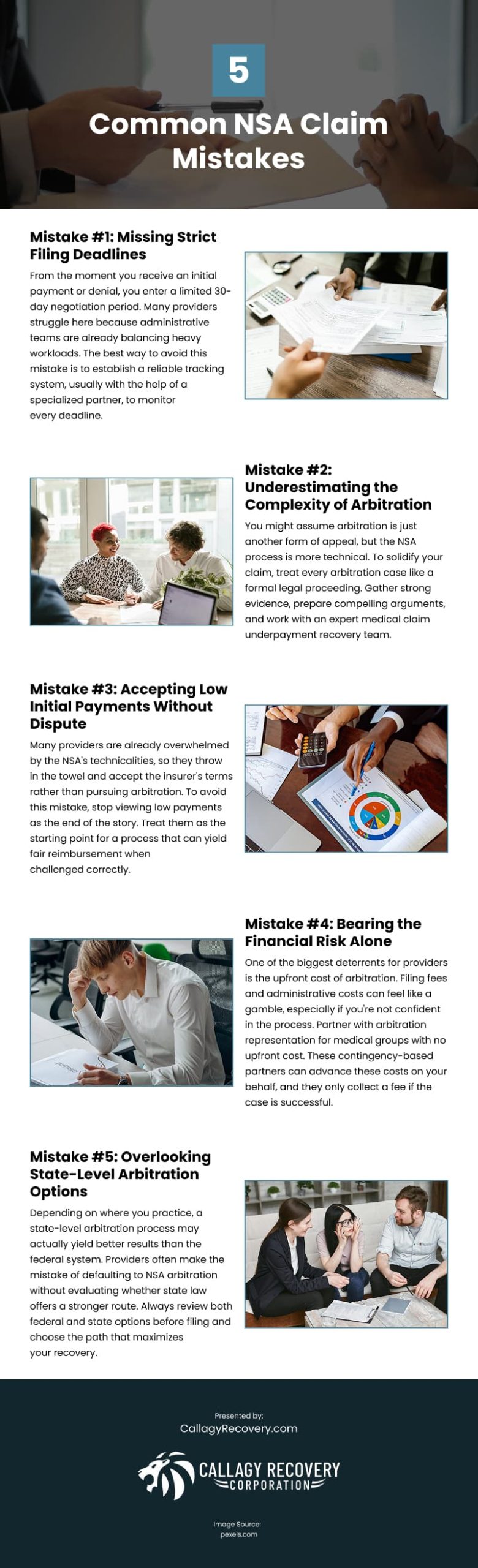

Navigating NSA claims can be complex and time-sensitive, with even experienced providers at risk of losing revenue due to avoidable errors. This infographic highlights five common mistakes made in NSA claims.