Medical Claims Recovery Services

Arbitration Support

Just as the medical world continues to evolve with new discoveries and treatments, the federal and state-level dispute systems for medical providers are always changing. But there’s one critical thing you need as you navigate the dispute systems: arbitration support.

When insurers underpay or deny valid claims, you need structured support that helps you gather evidence, prepare persuasive submissions, and navigate strict filing timelines. You also need arbitration support for denied claims with no upfront cost so you can pursue high volumes of eligible cases without adding financial strain to your operations.

Emergency Care Reimbursement Services

Emergency care claims create some of the most challenging reimbursement scenarios in the healthcare industry. When insurers reduce payments, deny emergency services, or underestimate the complexity of the care you provided, your revenue takes an immediate hit.

These cases require fast action, precise documentation, and a deep understanding of which recovery route applies: federal Independent Dispute Resolution (IDR) under the No Surprises Act or state-level arbitration processes. This distinction determines the strategy, timeline, and outcome of your recovery effort.

Federal Arbitration Services

Federal arbitration under the No Surprises Act has become a core financial safeguard for hospitals, medical groups, surgical centers, and surgeons facing persistent underpayments or improperly denied out-of-network claims. You encounter complex billing scenarios, inconsistent payer logic, and initial payments that fall far below the real value of your services.

You try to resolve the dispute and receive your full reimbursement, but make no progress. When the open negotiation period fails, you need arbitration representation for hospitals with no upfront cost. You need a partner with the experience to strengthen your case and guide you through each federal requirement.

Federal NSA Services

The federal No Surprises Act (NSA) went into effect on January 1, 2022, creating a legal and financial pathway for medical providers to seek fair reimbursement from insurance carriers—without balance billing patients.

At Callagy Recovery, we specialize in navigating the NSA’s complex arbitration process, ensuring providers get paid what they deserve for out-of-network emergency care.

Healthcare Revenue Recovery Services

Healthcare revenue recovery has become an essential part of financial sustainability for hospitals, surgical centers, multi-specialty groups, and surgeons. You face persistent underpayments and improperly denied claims that disrupt your cash flow and strain your RCM workflows.

Repeatedly encountering these issues is frustrating, but there is a solution: healthcare revenue recovery by arbitration experts who can step in and escalate eligible disputes through both federal and state-level processes.

Hospital Claim Recovery Services

When the providers in your hospital deliver care, you expect to be reimbursed fairly and on time. Yet insurance underpayments, delayed payments, and outright denials continue to drain revenue from hospital systems nationwide.

You deal with insurance disputes that require deep technical knowledge, extensive documentation, and constant follow-up. Meanwhile, your internal team is balancing utilization reviews, compliance work, and mounting payer requirements. You need a recovery process that strengthens your revenue cycle rather than slowing it down. This is where hospital claim recovery services become essential.

Independent Dispute Resolution

Federal Independent Dispute Resolution (IDR) under the No Surprises Act (NSA) continually shapes how hospitals, medical groups, surgeons, and surgical centers challenge denied or underpaid out-of-network claims.

If you operate across multiple states or provide high-acuity services, you’ve likely experienced inconsistent payments, low initial determinations, or insurer tactics that minimize the reimbursement you should receive. The IDR system exists to address those issues. You need end-to-end federal IDR representation that removes guesswork, protects eligibility, and gives your organization a fair chance to secure appropriate payment.

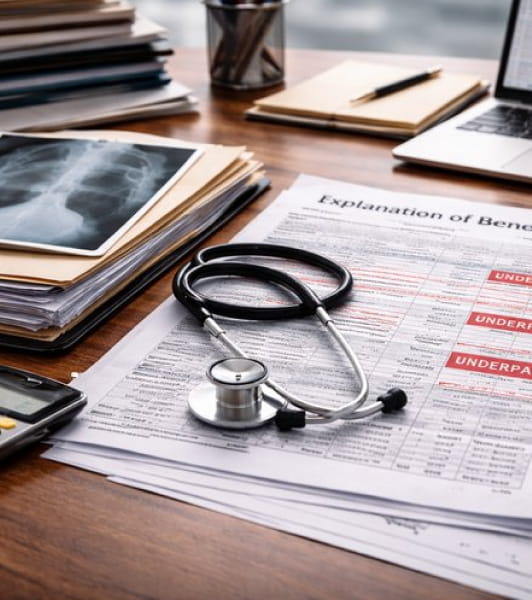

Insurance Underpayment Appeal Services

Insurance underpayments create one of the most persistent financial challenges in modern healthcare. When insurers reduce payment for a completed case, you feel the impact immediately.

These decisions often affect emergency care, surgical cases, out-of-network encounters, and high-complexity procedures that require significant time and clinical skill. You need a structured pathway to recover that lost revenue, and you need an understanding of whether the underpayment belongs in Federal IDR under the No Surprises Act or in a state-level arbitration system that governs the dispute in your region.

Medical Claim Underpayment Recovery

Medical claim underpayments are one of the most damaging and overlooked revenue losses in healthcare. Insurers often reduce payments without explanation, ignore the clinical intensity of your work, or apply internal methodologies that have nothing to do with state or federal reimbursement standards. These patterns create sustained financial pressure on your facility, especially when these underpayments accumulate across thousands of encounters each year.

Naturally, you want to keep your focus on treating patients, making it nearly impossible to spend the time necessary to pursue reimbursement. That’s why it’s so crucial to seek medical claim underpayment recovery by arbitration experts using a structured and legally supported approach.

No Surprises Act Arbitration and Recovery Services

The No Surprises Act created one of the most important financial protection systems for out-of-network providers in modern healthcare.

When insurers issue low initial payments, deny legitimate emergency cases, or reduce complex procedures without support, you now have a federal pathway to challenge those reductions and recover revenue you previously wrote off. This is why providers across the country rely on No Surprises Act expert representation to navigate federal Independent Dispute Resolution (IDR) and secure full payment for their work.

Out-of-Network Recovery Services

Performing out-of-network care impacts your revenue in ways that ripple across your entire organization. When you care for out-of-network patients in emergency visits, surgical procedures, or high-acuity cases, insurers often reimburse you far below what you deserve. That leaves you to absorb the financial strain, even when your clinical teams provide life-saving care. That strain only grows when underpaid claims remain unresolved because your internal staff lacks the time or resources to pursue complex appeals.

This is where out-of-network reimbursement recovery becomes essential. You need a structured, expert-driven approach that helps you pursue higher reimbursements, manage arbitration filings, and secure the full value of the services you provide. With out-of-network claim recovery by arbitration specialists who have deep experience in federal and state-level frameworks, you gain a solution that meets the increasing demands of today’s reimbursement landscape.

State Law Services

Many states have enacted their own out-of-network billing protections and arbitration frameworks – often predating the federal No Surprises Act. Each state law comes with its own rules, timelines, and financial caps.

State-Level Arbitration Services

Healthcare providers across the country continue to navigate complicated, rapidly shifting state arbitration frameworks to resolve payment disputes between out-of-network providers and commercial insurers. While the federal No Surprises Act (NSA) created a national system for Independent Dispute Resolution, many states still have their own arbitration processes. Each state has unique rules, deadlines, eligibility requirements, and documentation standards.

For organizations working in multiple jurisdictions, this environment creates layers of legal ambiguity. In several states, arbitration has become the most reliable path for challenging low insurer payments. This is especially true for surgical centers, specialty groups, hospitals, and high-volume practices.

Our Process

Callagy Recovery grew out of the Callagy Law firm with a profound understanding of the No Surprises Act. We are pioneers in medical revenue recovery and among the first filers in the NSA process. With our experience and cutting-edge technology and AI, Callagy Recovery is one of the most respected and longest-standing members of the out-of-network recovery industry.