If you’ve ever felt like an insurer is stalling after underpaying a claim, you’re probably right. And the cost of that delay is higher than you think. Under the No Surprises Act (NSA), you have a limited window to initiate arbitration after receiving an insurer’s initial payment or denial. Miss that window, and your right to dispute the claim disappears.

What makes this even more frustrating is how insurers use subtle tactics to run down the clock without you realizing it. They delay notifications, mislabel communications, or send incomplete payment details, leaving you unaware that your arbitration window has already started. By the time you catch it, your eligibility to challenge the payment is gone. And so is your revenue.

Understanding how these quiet delays work is the first step toward stopping them from draining your reimbursements. Partnering with hospital claim recovery services on insurance disputes can ensure you have expert guides throughout the process.

(Drazen Zigic/Freepik)

How the NSA’s Arbitration Timeline Works

The NSA’s Independent Dispute Resolution (IDR) process was designed to create fairness between providers and insurers. Once you receive an insurer’s payment or denial, you enter a 30-business-day negotiation window. If the dispute isn’t resolved, you have just four business days to initiate arbitration after that negotiation period ends.

That’s a short timeframe under the best circumstances. But when insurers create confusion about when the clock actually starts, it becomes nearly impossible to keep up without a dedicated tracking system.

You might assume your negotiation window hasn’t opened yet. However, in many cases, insurers start the countdown as soon as they send a payment notice, even if that notice is buried in an automated system or missing critical details.

The Subtle Delay Tactics Insurers Use

Insurers rarely come right out and tell you they’re running down your arbitration clock. Instead, they use tactics that seem procedural or harmless on the surface but are designed to create uncertainty and inaction.

Common delay tactics include:

- Sending partial or unclear explanations of payment (EOPs): These limit your ability to identify underpayments promptly.

- Labeling responses as “pending review” or “under appeal”: This creates the impression that you can’t move forward when your arbitration window is actually shrinking.

- Posting payments late in the month: Delayed postings push your internal processing past key filing dates, shortening the time you have left to act.

These quiet tactics add up. Every day lost brings you closer to forfeiting your right to arbitration.

Why You Can’t Rely on Insurers to Track Deadlines

It’s tempting to assume insurers will follow the same timelines you do, but in practice, they don’t. Many providers discover too late that the clock started ticking long before they even realized it.

Insurers are not required to remind you of your arbitration rights or deadlines. In fact, some take advantage of that silence. They know most providers lack the internal systems to monitor every timeline across thousands of claims, and they use that gap to their advantage.

That’s why it’s essential to take ownership of the process. The burden to track, calculate, and act on these timelines falls entirely on you. Any missed opportunity translates directly into lost reimbursement.

The Cost of Missed Arbitration Windows

Missing a filing window doesn’t just mean one lost claim. It sets a costly precedent. Insurers see missed deadlines as confirmation that they can underpay without consequence. Over time, that habit becomes systemic.

If you lose eligibility for arbitration on just a handful of claims each month, the financial impact can snowball into hundreds of thousands of dollars in unrecovered revenue annually. Those funds could have supported staff salaries, equipment upgrades, or expanded patient services. But instead, they remain in the insurer’s pocket.

By contrast, providers who stay vigilant with timelines often recover five to ten times more than the insurer’s initial offer when cases go to arbitration. The difference comes down to timing and consistency.

How to Detect and Prevent Insurer Delays

Stopping these quiet delays requires a proactive, systemized approach. You can’t rely on insurers to play fair. You need to create internal safeguards that ensure no claim slips through unnoticed.

Here are three key ways to stay protected:

- Implement strict timeline tracking: Use software or dashboards that automatically flag when a claim’s negotiation or arbitration window is about to expire.

- Verify all insurer communications: Don’t assume an EOP or partial payment notice is just a placeholder. Verify dates and documentation to confirm whether it starts your official negotiation period.

- Centralize claim review: Keep all correspondence, payment data, and arbitration records in one place so your team can respond quickly to any disputes.

These measures ensure that no claim or opportunity for recovery gets buried under administrative noise.

The Role of Documentation in Avoiding Missed Deadlines

Even if you stay on top of timelines, incomplete or disorganized documentation can still create costly delays. Every claim you submit should have detailed records that tie directly to the insurer’s response, including:

- Dates of submission and payment

- EOBs and all correspondence

- Notes on negotiation attempts or communications with the insurer

By keeping this documentation clear and accessible, you’ll be able to verify when your arbitration eligibility window actually begins and ensure you can respond before it closes.

If your team struggles to manage this level of detail, consider investing in out-of-network claim recovery by arbitration experts. These professionals not only track timelines but also fully document, file, and follow every claim through to completion.

Why Insurer Delays Are a Strategic Problem, Not Just an Administrative One

These quiet delays aren’t random mistakes but part of a broader strategy to limit payouts. Insurers know the arbitration process favors well-prepared providers. By keeping you off-balance with inconsistent notifications and incomplete data, they reduce the likelihood that you’ll pursue disputes.

Recognizing this dynamic helps you shift your mindset. Arbitration is a financial defense strategy. Every claim you preserve for arbitration is a potential recovery that strengthens your organization’s bottom line.

Don’t Let the Clock Run Out on Your Revenue

Every day matters when it comes to arbitration. Insurers may count on confusion and delay to close your filing window quietly, but with the right tracking, documentation, and partnerships, you can stop that from happening.

The difference between lost and recovered revenue isn’t luck; it’s awareness. When you control the process, you control the outcome. By staying alert to insurer delays and protecting your arbitration timelines, you ensure your organization gets paid what it’s owed, not what insurers hope you’ll settle for.

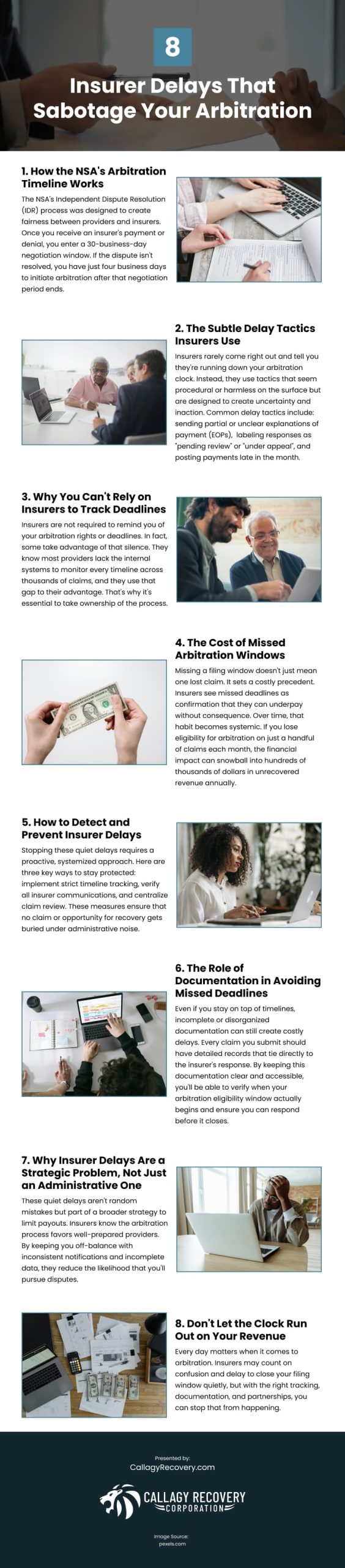

Infographic

If you suspect an insurer is delaying payment after underpaying your claim, you’re not alone. These tactics can seriously affect your reimbursements. This infographic explains how insurer delays can sabotage your arbitration and what to watch for.